LUT GST REGISTRATION RAJASTHAN

LUT GST REGISTRATION RAJASTHAN

LETTER OF UNDERTAKING GST

LETTER OF UNDERTAKING GST

LUT Registration Rajasthan, Any registered person availing the option to supply goods or services for export /SEZs without payment of integrated tax has to furnish, prior to export/SEZs supply, a Letter of Undertaking (LUT), if he has not been prosecuted for tax evasion for an amount of Rs 2.5 Crore or above under the CGST Act/IGST Act/Existing law. Example of transactions for which LUT can be used are:

Zero rated supply to SEZ without payment of IGST.

Export of goods to a country outside India without payment of IGST.

Providing services to a client in a country outside India without payment of IGST.

LUT IN GST LETTER OF UNDERTAKING

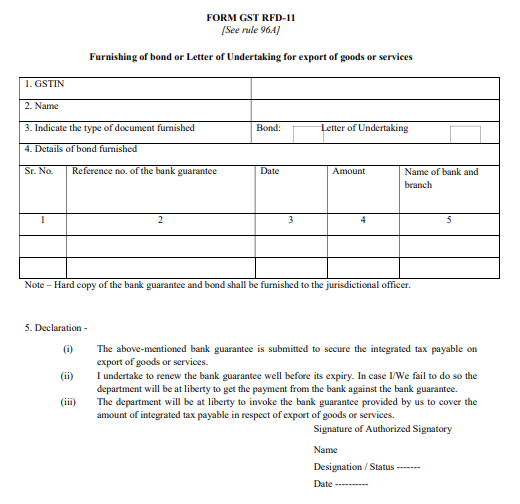

All registered taxpayers who have zero-rated supply of goods or services have to furnish LUT in Form GST RFD-11 before affecting such supply.

Primary authorized signatory/Any other Authorized Signatory needs to sign and file the verification . Authorized signatory can be the working partner, the managing director or the proprietor or by a person duly authorized by such working partner or Board of Directors of such company or proprietor to execute the form.

LUT BOND FULL FORM IN GST

VALIDITY OF LUT

LUT stands for Letter of Undertaking to supply goods or services for export /SEZs without payment of integrated tax.

LUT IN GST PROCESS RAJASTHAN

Exporter has to file an application in Form GST RFD-11 along with the required documents.

Officer will verify the application and supporting documents.

If the proper officer is satisfied, he will issue a LUT in Form GST RFD-10 .

Exporter has to furnish the LUT at the time of exporting the goods.

DOCUMENTS REQUIRED FOR LUT GST REGISTRATION RAJASTHAN

LUT cover letter- Request for acceptance that is duly signed by the authorized person.

- GST registration Certificate

- PAN card of the entity

- KYC of the authorized person

- IEC code Certificate copy

- GST RFD 11 Form

- Cancelled cheque

- Authority letter

- Undertaking on stamp paper wherein the tax payer declare that they have not been prosecuted for any of the existing laws in case where the amount of tax evaded exceeds two hundred and fifty lakh rupees.

FOR APPLICATION & CONSULTATION

CONTACT @ 0869609471

Ajmer, Kekri, Kiranipura, Kishangarh, Nasirabad, Pushkar, Sarwar, BeawarVijainagarAlwar, Behror, Bhiwadi, Govindgarh, Khairthal, Kherli, Kishangarh, Rajgarh, Tijara, Banswara, Kushalgarh, Partapur

ntah, Atru, Baran, Chhabra, Chhipabarod, Kherliganj, Mangrol, Balotra, Barmer, Gudamalani, Siwana, Dhorimana, Sheo, Sindhri, Samdari, Bayana, Bharatpur, Bhusawar, Deeg, Farsho, Kaman, Kumher, Nadbai, Nagar, Weir, Jurehra, Pahadi, Asind, Beejoliya, Kalan, Bhilwara, Gangapur, Gulabpura, Jahazpur, Mandalgarh, Shahpura, Bikaner, Deshnoke, Dungargarh, Khajuwala, Loonkaransar, Udasar, Napasar, Nokha, Budhpura, Bundi, Indragarh, Kaprain, Keshoraipatan, Lakheri, Nainwa, Bari Sadri, Begun, Chittorgarh, Kapasan, Nimbahera, Rawatbhata, Bidasar, Chhapar, Churu, Dungargarh, Rajaldesar, Rajgarh, Ratangarh, Ratannagar, Sardarshahar, Sujangarh, Taranagar, Bandikui, Dausa, Lalsot, Mahwa, Mandawar, Bari, Dholpur, Rajakhera, Dungarpur, Galiakot, Sagwara, Simalwara, Bhadra, Hanumangarh, Nohar, Pilibanga, Rawatsar, Sangaria, Bagru, Bairat, Chaksu, Chomu, Jaipur, JamwaRamgarh, Jobner, Kishangarh, Renwal, Kotputli, Phagi, Phulera, Sambhar, Shahpura, Jaisalmer, Pokhran, Bhinmal, Jalore, Sanchore, Ahore, Raniwara, Aklera, Bakani, BhawaniMandi, Jhalawar, Jhalrapatan, Kolvi, Mandi, Rajendrapura, Manohar, Thana, Pirawa, Baggar, Bissau, Buhana, Chirawa, Gothra, Gudhagorji, Jhunjhunu, Khetri, Kodesar, Malsisar, Mandawa, Mukandgarh, Nawalgarh, Pilani, Surajgarh, Togra, Sawroop Singh, Udaipurwati, Vidyavihar, Bilara, Jodhpur, Phalodi, Piparcity, Bhopalgarh, Osian, Hindaun, Karauli, Todabhim, Mandrayal, Suroth, ShriMahaveerJi, Mahu, Ibrahimpur, Kailadevi, Karanpur, Kurhganv, Langra, Rodhai, Chechat, Kaithoon, Kota, Kumbhkot, Modak, RamganjMandi, Sangod, SatalkheriSogariya, Suket, Udpura, Basni, Belima, Didwana, Goredi, Chancha, Kuchaman City, Kuchera, Ladnun, Makrana, Merta City, Mundwa, Nagaur, Nawa, Parbatsar, Bali, Falna, Jaitaran, Marwar Junction, Pali, Rani, Nimaj, Sadri, Sojat, Sojat Road, Sumerpur, Takhatgarh, Nadol, ChhotiSadri, Pratapgarh, Amet, Dariba, Devgrah, Nathdwara, Rajsamand, Gangapur, Mahu, Kalan, SawaiMadhopur, Todra, Fatehpur, Khandela, Khatushyamji, Lachhmangarh, Losal, Neem-Ka-Thana, Ramgarh, Reengus, Sikar, Sri Madhopur, Abu Road, Mount Abu, Pindwara, Sheoganj, Sirohi, Anupgarh, Gajsinghpur, Ganeshgarh, Karanpur, Kesrisinghpur, Padampur, Ganganagar, Raisinghnagar, Rawla, Mandi, Sadulshahar, Sri Ganganagar, Suratgarh, Vijainagar, Deoli, Malpura, Niwai, Todaraisingh, Tonk, Uniara, Vanasthali, Dev, Dham, Jodhpuriya, Manoharpura, Kacholiya, Bhalariya, Bhinder, Dhariawad, Fatehnagar, Jhadol, Kanor, Kherwara, Chhaoni, Newa, Talai, Rikhabdeo, Salumbar, Saradit, Udaipur

lut in gst, lut gst, lut under gst, lut bond, lut for export, lut full form in gst, lut registration, lut number in gst, gst lut, lut in export, lut number on invoice, letter of undertaking in gst, export invoice under gst with lut, lut invoice format, lut filing, lut certificate in gst, lut in gst portal, lut gst meaning, gst undertaking format, lut copy for export, export invoice format under lut in excel, lut for export of services, export invoice format under gst with lut in excel, export invoice format under gst with lut, gst lut filing, lut certificate for export, gst lut registration, lut bond for export, export invoice format under lut, lut for gst, lut no on invoice, lut gst export, lut number to be mentioned on invoice, lut application in gst, gst lut certificate, lut apply in gst, lut registration in gst, lut invoice, lut bill format, lut filing in gst, lut no for export, lut required for export of services, export invoice under lut, invoice format for export of services under lut, lut gst refund, lut export invoice format, lut invoice format under gst, lut registration process, export under lut invoice format, format of export invoice under gst with lut, e way bill for export under lut, gst lut application, gst export invoice format under lut, bond for export under gst, apply for lut under gst, gst refund under lut, lut apply online gst, online application for lut under gst, gst lut registration online, lut format for gst tax invoice

CONTACT 08696019471