PAN CARD JAIPUR CONSULTANTS

PAN CARD ONLINE JAIPUR

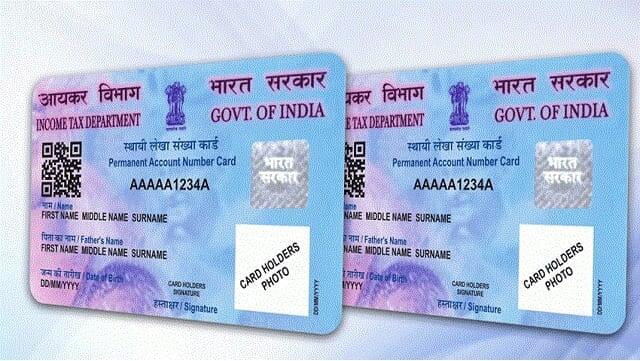

PAN card in Jaipur (Permanent Account Number) card is a 10-digit alphanumeric identifier issued by the Income Tax Department to individuals, companies, and firms. It serves as a unique identification for all financial transactions, tax payments, and record-keeping purposes. PAN card is mandatory for financial transactions above a certain amount and for various other purposes, such as opening a bank account, receiving taxable salary or professional fees, sale or purchase of assets etc.

PAN CARD APPLICATION JAIPUR

The application for applying PAN Card in Jaipur (Permanent Account Number ) should be made in prescribed Form with proper jurisdiction to NSDL(Protean/NSDL/UTI) as per Income Tax Rules.

- New Application of PAN

- Correction / Rectification of existing PAN - Change of photograph, Change in name, Mismatch of Signatures

- Know Your PAN

- Status/Track Your PAN/TAN

- Reprinting of PAN / If lost or updation of address in the Income Tax records

DOCUMENTS REQUIRED FOR PAN CARD APPLICATION

To apply for a Permanent Account Number (PAN) card in Jaipur , the following documents are required:

- Proof of identity (Aadhar card, Passport, Voter ID, Driving License)

- Proof of address (Aadhar card, Passport, Voter ID, Driving License, Bank statement, Utility bill)

- Passport size photographs

- Completed PAN card application form (Form 49A)

Note: For non-individual applicants such as firms, trusts, HUF, etc. additional documents may be required.

PAN CORRECTION / PAN REPRINT

DUPLICATE PAN CARD

To correct errors on a PAN card/Reprint,

Obtain the PAN correction form (Form 49A) .

Fill out the form with the correct details, making sure to sign and date it.

Attach supporting documents such as a proof of identity, proof of address, and proof of date of birth, as specified in the form.

Submit the form and documents to a PAN Card Consultant .

Once the correction is processed, You will get PAN card delivered at Address mentioned in Form.

Note: It is important to ensure that contact details and address on the PAN database are up-to-date to avoid any delays or issues in receiving the reprinted PAN card.

PAN AADHAAR LINK JAIPUR

Linking your Permanent Account Number (PAN) with your Aadhaar card is mandatory for Indian citizens as per the Income Tax Department. It helps in better tracking of financial transactions and also helps in avoiding multiple PAN cards for a single person.: You can also link your PAN and Aadhaar by visiting a PAN service center or TIN-FC (Tax Information Network-Facilitation Center).

It is important to note that the name as mentioned on your PAN card and Aadhaar card should match for successful linking.

PAN CARD STATUS JAIPUR

To check the status of your PAN card Jaipur application with NSDL, follow the steps below:

- Visit the official NSDL website at https://www.tin-nsdl.com/.

- Under the "Services" tab, select "PAN".

- Click on "Track PAN Card Application Status".

- Select the application type (New PAN, Changes or Correction in PAN Data).

- Enter your 15-digit acknowledgement number or 10-digit PAN number in the field provided.

- Enter the captcha code displayed on the screen.

- Click on the "Submit" button.

You will then be able to see the current status of your PAN card application. The status could be "under process", "dispatched", or any other relevant information. If you have any issues or concerns with your PAN card application, you can also contact the NSDL customer care for further assistance.

PAN CARD BENEFITS

A Permanent Account Number (PAN) is a unique ten-digit alphanumeric identification number issued by the Indian Income Tax Department to individuals, companies, and other entities in India for the purpose of tracking financial transactions.

Some of the benefits of having a PAN card in India are:

It is a mandatory document for certain financial transactions such as opening a bank account, buying or selling property, paying taxes, etc.

It is a proof of identity and can be used as a valid identification document for various purposes.

It is a useful document for individuals who are self-employed or have multiple sources of income, as it is required for filing income tax returns.

It is also useful for individuals who receive gifts or are beneficiaries of trust funds, as it is required to report such income.

It is a useful document for businesses, as it is required for various business-related financial transactions.

It is a useful document for non-resident Indians (NRIs) who wish to invest in India, as it is required for financial transactions in India.

FOR APPLICATION & LEGAL CONSULTATION

CONTACT @ 8696019471

CONTACT 08696019471