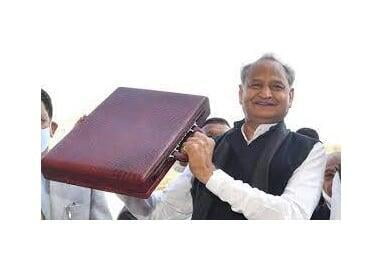

RAJASTHAN BUDGET 2022 HIGHLIGHTS

Budget 2022-23

Tax Proposals

Covid- 19 has adversely affected all sectors of economic activity such as Tourism & Hospitality, Real Estate, Farmers, Entrepreneurs, Traders and Common Man along Revenue of the State. Looking to this, no new tax was levied in last Budget and relief of approximate Rs. 900 er. was provided. Petrol and diesel VAT rates were reduced by Rs. 6 and 7 per liter respectively, after Jan., 2021, This resulted into addition burden of Rs. 6 thousand crores on State revenue. The economy is not yet fully recovered, therefore, no new tax is proposed in the Budget 2022-23 and around 1500 crores relief has been provided to all sectors.

1. Common Man :

• To provide Social and Economic support -

Provision for transfer of ownership of residential Nazool properties for lower income group persons occupied prior to year 2000.

► 100% exemption of Motor Vehicle Tax for purchase of four wheeler with

automatic transmission upto the cost of Rs. 10 lakh and Adapted/Retrofitted two wheelers/three wheelers by the specially abled persons.

1% rebate on stamp duty on vacant or constructed residential plots upto 100 Sq. yards.

1% rebate on stamp duty on vacant or constructed commercial plots upto 50 Sq yards.

Reduction in stamp duty from Rs. 5000 to Rs. 500 on release deed of ancestral property above the value of Rs. 10 lakh.

100% exemption of Stamp Duty on Gift Deed in favor of daughter or daughter in-law and wife.

Reduction in stamp duty from 6% to 5% and registration charges from 1% to

0.5% on purchase of Immovable property by senior citizens more than 60 years of age.

► 100% exemption of Stamp Duty & registration fees on reverse mortgage

executed in favour of senior. citizens more than 60 years of age.

100% exemption of Stamp Duty & registration fees on loan documents executed for Educational loan by students.

• Budget for "Late Shri Gurusaran Chabra Jan Jagrukta Abhiyan" increased from 5 er.

to 10 er.

• Model Sub-registrar offices will be opened in Jaipur, Jodhpur and Bhiwadi in line with the Passport Offices.

• Creation of Tax Facilitation and Support Centre at Commercial Tax Headquarter with the cost of Rs. 100 Cr. and establishment of an additional divisional transport office at Jaipur.

2. Farmers and Agro based Entrepreneur :

• Interest subsidy for establishment/ expansion or agro based MSME under Chief Minister Small Industries Promotion Scheme enhanced from 8% to 9%.

• The period of Interest Exemption Scheme 2019 for Mandi Fee/Allotment Fee, extended upto 30th September, 2022.

• Allotment of plots at reserve price in Mandi Yards for application of traders pending prior to the year 2010.

• Allotment of Government Land for new Mandies and Mini Food Parks announced in budget year 2020-21, 2021-22 and this budget at free of cost.

• Exemption of Farmers Welfare Fee payable till 31March, 2022, extended for one more year.

3. Tourism and Hospitality Sector :

• Tourism and Hospitality Sector accorded the status of industry, thereby fulfilled the demand pending for years.

• Rajasthan Rural Tourism Scheme be introduced and 100% exemption from stamp duty, 100 % reimbursement of SGST for 10 years and 9% interest subsidy for the loan amount up to Rs. 25 lakh.

• The buildings constructed prior to 01.01.1950 be treated as heritage properties and concessional rate of stamp duty be charged for purchase/lease of these properties for hotel purpose.

• Rates of land for resort, sports resort, health resort, camping site, amusement park, animal safari park will be determined equal to agriculture rates of convention center/community hall will be equal to residential rates in urban areas and agriculture rate in rural area.

• Reimbursement of SGST for hotel and tour operators up to 50% for the period January 2022 to March, 2022.

4. Industries:

• Exemption of e-way bill for transportation of goods within the city extended from Rs. 1 lakh to 2 lakh.

• The period of exemption for MSMEs from sanctions and inspection extended from 3 to 5 years.

• Exemption from conversion charges for converting private agriculture land for white category industry/enterprises purposes in rural areas.

• Upper limit of stamp duty reduced to Rs. 15 lakh for loan instruments/debt assignment executed by industries.

• Upper limit of stamp duty reduced to Rs. 50 er. on instruments of merger/demerger of companies.

• In RIICO areas for specified industries plots will be allotted directly along with auction process.

5. Investment promotions:

• Benefits under RIPS-2010 and RIPS-2014 extended for 1 year for the eligible enterprises.

• Enterprises availing benefits of customized package under RIPS-2003, RIPS-2010 and RIPS-2014 shall also be eligible under RIPS-2019 if their commercial production start or would be started in the operative period of RIPS-2019.

• Enterprises established in Petroleum, Chemicals and Petrochemicals Investment Region (PCPIR) at Rajasthan Refinery Barmer for sunrise sectors will get benefits of RIPS-2019 thrust sector.

• Provision for capital subsidy to the units not getting benefit of SGST reimbursement in the State.

• Service sector units in Inland Container Depot (ICD) be accorded status of Thrust Sector under RIPS-2019.

• Capital subsidy limit under RIPS-2019 for Thrust Sector-Gems & Jewellery increased from Rs. 25 lakh to Rs. 1 er.

• Provision of capital subsidy for Sports Good Sectors and Private Sports Academes up to Rs. 1 er. under Service Sector of RIPS-2019.

• New Rajasthan Investment Promotion Scheme-2022 will be introduced with better benefits to enterprises.

• Provision of Rs. 150 er. for Chief Minister Small Industry Promotion Scheme.

6. SC/ST and Weaker Sections entrepreneurs :

• "Dr. Bhimrao Ambedkar Rajasthan Dalit, Adiwasi Udyam Protsahan Yojna-2022" be introduced with following benefits -

With the cost of Rs. 100 er. Incubation cum Training Centre be established with cooperation of CII/DICCI for helping deprived sections of the society to establish industries.

In RIICO areas, allotment of plot size up to the limit of 4000 sq. mtr. in place of present 2000 sq. mtr. limit and increase in reservation from 5% to 6%.

100% exemption from interest on installments of land cost and 75% rebate on conversion charges.

100 % exemption of stamp duty for purchase, lease and mortgage of land.

► 1% additional interest subsidy under Chief Minister Small Industry Promotion Scheme.

100% reimbursement of SGST for 7 years.

7. Amnesty Schemes :

• To recover outstanding demands the following Amnesty Schemes-2022 will be introduced with simplification of procedures, waiver of interest and penalty along

with partial rebate in tax amount for better benefits :

► Commercial Taxes : repealed Acts - Sales Tax, VAT, Entry Tax etc.

► Registration and Stamps

► RIICO

► Transport

► Excise

► Colonization

► Mining

► DISCOMs - Electricity Vigilance Checking Report (VCR)

8. Real Est'3te :

• Rebate in DLC amount to large residential and commercial plots.

• Extension of one year in the time limit for 2% rebate of stamp duty on purchase of flats upto the value of Rs. 50 lakh.

• Rebate in stamp duty on successive sale of properties within 1 to 3 years.

9. Mining Lease holders :

• Mining Lease/Quarry Licenses of minor minerals expiring on 31.03.2025 be extended up to 31.03.2040 on certain premium amount.

• Removal of maximum limit of 4 hectares mining lease for minor minerals on Khatedari land.

• Execution of lease agreement without environment clearance on the condition that mining activity will be started after getting environment clearance.

• Reduction in the limit of dead rent/license fee from 10 times to 5 times and maximum premium amount from Rs. 10 lakh to Rs. 5 lakh for transfer of minor mineral lease.

10. Transport :

• Exemption of 50% Motor Vehicle Tax on CNG Kit Retrofitment vehicles.

• Divisional Contract Carriage Permits be allowed with 70% rebate on Motor Vehicle Tax charged from all Rajasthan permits.

• The buses depositing tax from April to February regularly be entitled for 25% Rebate in Motor Vehicle Tax for the month of March.

• Maximum limit of surrendering RC be extended upto 180 days in a calendar year.

11.Media:

• The allowable limit for sub-letting constructed buildings by Media be increased from 40% to 60% of built-up area.

CONTACT 08696019471